dYdX

A new era for decentralized perpetual protocols

1 Introduction

This article gives an overview of the current crypto exchange landscape from centralized exchanges to decentralized ones. It compares the volumes among the largest exchanges and the large amount of value capture an exchange can bring. Then we focus on one particular decentralized futures1 exchange dYdX and postulate how it can increase volume and revenue generation in this lucrative crypto sector.

There are five main uncorrelated drivers for the thesis:

Crypto volumes will increase.

Decentralized volumes will increase relative to centralized volumes.

Decentralized perp volumes will increase relative to decentralized spot volumes.

Exchanges are natural monopolies and dYdX is the current king of decentralized derivatives.

dYdX's upcoming upgrades will allow it to maintain and increase its dominance in this space by running the full stack of borrow/lend, spot, and options while returning value to dYdX token holders.

In the first chapter (Crypto Exchanges), there will be a brief introduction to the sector and will touch on thesis points (1), (2), (3) and (4). The latter chapter (dYdX) will give a primer on the current state of dYdX and focus on the last point (5).

2 Crypto Exchanges

One of the top2 product market fits for crypto are exchanges. Coingecko's top 100 list is primarily filled by three categories L1s (25), stablecoins (10), and exchanges(16)3. Of these three major subcategories, exchanges have the highest revenue generation, especially when it comes to returning value to token holders4.

Here we will further differentiate the exchanges and break them down into 4 sub-categories: centralized spot exchanges, centralized future exchanges, decentralized spot exchanges and decentralized future exchanges. Many of the centralized exchanges have both a perpetual and a spot trading operation, but this is not that common with the decentralized exchanges who tend to focus on one or the other.

Centralized Exchanges

There is currently about 100 billion of volume traded each day on the centralized exchanges5, down from the peak of 300b in 2021 and around 150b in 2022. This decrease is mostly due to the price of the assets dropping substantially in the recent market regime. If we put the volume in BTC terms, volumes have remained roughly steady for the past year and a half, and up substantially from the 2018-2020 era. Volumes will continue to increase as the market matures, but the climb will not be linear. Instead we can envision a piecewise function, where each new cycle moves the average daily volume multiples over the previous regime

Decentralized Exchanges

Uniswap ushered in a new era of decentralized exchanges with a simple yet intuitive liquidity formula, clean UI, and ETH base pair. Meanwhile, Curve also thrived as a stable swap with their concentrated liquidity formula. These two decentralized exchanges kicked off defi summer and have created viable alternatives to the centralized exchanges.

Ever since the collapse of FTX, the need for decentralized exchanges has never been more prevalent as they do not hold user funds and their smart contracts have proof of reserves. In addition, there is no KYC nor geoblocking making them readily accessible to all.

Looking at the volumes, we can see that decentralized exchange volume has also been trending up throughout time, especially when examining in terms of ETH which is the base pair for most of the assets. For the past half a year, we have been hovering slightly under 4 billion daily volume. Like their centralized counterparts, the volume growth is piecewise and exponential, and will continue to expand in the upcoming years.

Dex vs Cex

An interesting observation from the above charts is that the decentralized volumes are nowhere close to the centralized volumes due to a myriad of issues like MEV, higher fees, gas costs, and terrible UIs. That being said, these issues are being tackled and every generation of decentralized exchanges comes closer to competing with their centralized counterparts.

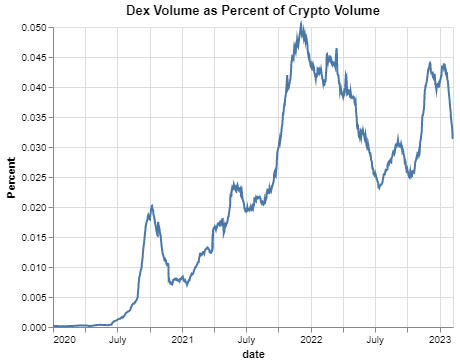

Below we can see a chart from Defi summer till present comparing the decentralized exchange volume (decentralized spot and perp) versus entire crypto volume (which includes centralized spot and perp). Defi currently is around 3-3.5% of the entire crypto volume but the graph is sloping upwards. This is a theme that will continue to trend in the upcoming years and once the above issues are fixed, this ratio has the potential to reach north of double digits.

Spot Dex vs Futures Dex

Previous analysis has grouped centralized and decentralized exchanges together, but now we split them up into futures and spot. Perhaps one of the most interesting aspects of the decentralized exchanges are how much volume is traded by spot exchanges vs future exchanges. From the inception, spot volume has always been greater than future volume on decentralized exchanges, a stark contrast to their centralized counterparts where futures trade multiples more. This does not really make that much sense, because futures have lower trading fees, less slippage, and better efficiency so this disparity is peculiar.

Below we have a chart that plots what percentage of volume perpetuals trade on centralized vs decentralized exchanges. We can see that the centralized venues always hovered around 70-80% after the initial surge in 2019 which is when FTX popularized cross margining and USD margined contract.

Admittedly, the Uniswap model makes providing liquidity on long tail assets very trivial (especially with liquidity incentives), and creating a different market microstructure. However, centralized exchanges actually have a higher percentage of altcoins traded. Taking a few snapshots of Binance data, around 70% of the volume is short tail: ETH to stable, BTC to stable, ETH to BTC, or stable to stable. That same criteria for Uniswap is north of 80%.

A simpler explanation is that the decentralized perpetual market is not mature enough. For the beginning of crypto there have been spot exchanges but futures only took off when Bitmex launched their perpetual swap. Even then it took FTX to turn everything from coin-margin to USD-margin three years later in 2019 for futures to really take off over spot. Admittedly the decentralized perp exchanges are still far more lacking than their centralized counterparts in terms of liquidity, coins, and charge higher fees. A few more iterations will solve these issues and we will see the decentralized perpetuals take over decentralized spot and nudge closer to that 70-80% mark of total volume traded.

Exchange Microstructures

Centralized spot, centralized futures, and decentralized spot exchanges are all more mature than decentralized futures exchanges and they exhibit monopolistic market microstructures. This intuitively makes a lot of sense because the liquidity begets more liquidity. All the traders wish to trade on the most liquid exchanges so the one that has the least amount of slippage is a much more attractive starting point, all other things equal.

Monopolies tend to form when there are large benefits to economies of scale which is exactly what happens with exchanges. Binance is the leading exchange for centralized spot and futures trading and they are able to hurdle fixed costs and drive down fees so they can maintain/increase market share. Last year Binance turned on no fees for a few BTC and ETH pairs. Similarly, they have the largest insurance fund (closing in on 1B) to protect the consumer in black swan scenarios.

Below we can see a time series graph of the volumes at each exchange. Binance is only getting more and more dominant and its market share of the centralized spot market went from around 40% at the start of 2020 to over 60% now. Its market share of the centralized perpetual market went from barely 10% at the start of 2020 to over 60% now. Due to the natural monopolistic advantages in this market this lead should not subside and Binance will grow beyond this 60% market share.

A similar image is painted for the decentralized spot market6. This is more fragmented due to every chain having its own dex and liquidity mining incentives helping out other exchanges, but by and large Uniswap has dominated; in fact, there are even plans to go to BSC which will put a lot of pressure on Pancake swap.

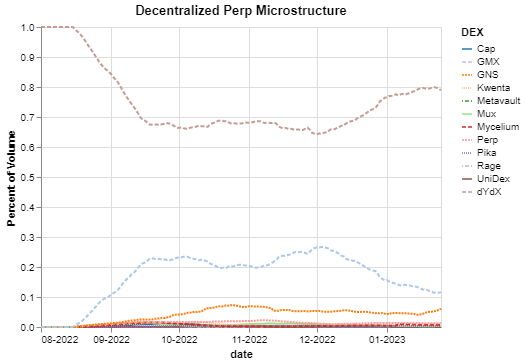

So what does the microstructure of existing decentralized futures look like? These exchanges are newer and there is less data but we have a complete snapshot from the middle of 2022. For the last few months we can see dYdX maintain a healthy and strong lead over the second and third closest competitors GMX and GNS.

3 dYdX vs Competitors

dYdX V3 is the current state of the art decentralized perpetual trading platform. It combines the best trading features and feel of a centralized exchange with the security and non-custody of decentralized exchanges so users get the best of both worlds.

V3 has over 30 different markets, supports cross margining, a robust liquidation engine, and a very detailed and well documented api. Not to mention has the lowest fees by far out of any decentralized perpetual exchange with similar amounts of slippage. For reference the next two exchanges GMX and GNS have .1% fees and .08% fees respectively. Traders trading below 100k monthly volume on dYdX trade for free and the highest paid taker fee tier otherwise is .05%, but goes as low as .02% while maker fees dip to 0% based on volumes.

Competitor’s Issues

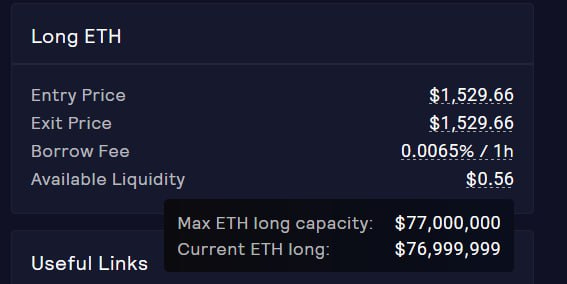

It is difficult to compare the orderbook model to an oracle based model like GMX and GNS but one of the largest issues on the oracle exchanges is that the capacity is capped by other participants. Here is a screenshot of the ETH market a few weeks ago and traders are unable to go long. During a strong rally, where speculators wish to express their long bias, this model is literally PVP on who executes first.

Competitor’s Advantages

This isn't to say dYdX V3 is superior in every aspect. Sometimes the best marketing of a platform is the token number going up and this has clearly been the case with GMX (up 100% in a year) and GNS (over 200% in a year) compared to dYdX which is down 50% in the same timeframe. This is partially due to vesting tokenomics but also with token use case.

GMX and GNS all kick back protocol revenues to their stakers so the tokens are not just governance tokens. GMX and GNS stakers earn around 10-15% in yield annually. One of the biggest gripes of dYdX is that the token does not align with the usage of the product, something its competitors do very well. There is no inherent feedback loop where more volume helps the token price as the fees go to equity holders. That changes in V4 as token stakers can get distributed fees (more information below) which will be higher than its competitors.

The other advantage GMX and GNS have is geoblocking. Currently to access dYdX V3, a few jurisdictions are blocked. This is not the case with the other protocols. Geoblocking is a huge pain point as it makes it that much harder to trade. Geoblocking for the default V4 frontend7 is currently being discussed by the legal team.

As mentioned in the previous chapter, the current iteration is hands down the most popular decentralized derivative platform and laps its competitors in terms of volumes. That is not to say that v3 is not without its flaws and these have allowed its competitors to gain small market share. V4 addresses all of these major flaws.

4 dYdX V4

In June 2022, dYdX shocked the crypto community by moving to their own native chain, away from Starkware which housed V3. The easy move would have been to coast and add small improvements to V3, which is already head and shoulders above other decentralized perp platforms8. Instead, dYdX took a big risk by rebuilding most of the system from scratch in order to fully decentralize the system while increasing theoretical throughput, adding more finality to settlements, and minimizing MEV.

Advantages

Running a L1 enables the developers to customize the validators tasks and the various blockchain functions. Specifically, each validator runs its own off-chain order-book, but orders and cancellations are sent through the network and matched ensuring trades and committed to each block9 ensuring high throughput.

In addition, there will be no gas paid to submit and cancel orders; no other decentralized trading platform, spot or perp has this feature. Gas-less transactions are especially beneficial when markets are volatile and gas price shoots up as that is exactly when people want to be trading.

Finally, the new blockchain is built to be vertically integrated, meaning down the line it is easy to add and enable spot trading, borrow-lending, and options. This will allow dYdX to have all the features of a centralized exchange while adhering to the open decentralized principles.

Challenges

The migration is not without significant challenges. All of the existing infrastructure from Starkware (that previously could be built upon) needs to be rebuilt from the ground up. Apart from customizing the core node for trading purposes, an indexer is also needed to power the API and websockets. The indexer takes data on core blockchain and stores it in an efficient manner which will in-turn power the APIs. Essentially, dYdX needs to build the Graph protocol for cosmos. Apart from the back-end and middleware, the front-end and mobile UIs will also get an overhaul.

Adding New Markets

Right now there are not many perps to trade and low liquidity outside of BTC and ETH (maybe top 10 coins) on the decentralized perpetual platforms. Binance has over 200 different perpetual markets while FTX had over 500 before they closed. Currently, dYdX offers around 35 markets while GMX offers less than 10.

In v4, anyone will be able to propose to add a market through governance. When it passes, it will get put in isolated margin, and depending on liquidity can get added to cross-margin and fully permission-less trading10. Attention span is huge in crypto and many people want to constantly rotate and trade the hot new launch. Imagine a world where the dYdX was the first platform to list a perpetual on the day of token drop like $BLUR.

When launch?

The launch has been pushed back a few times due to delays. Initially, v4 was slated to launch at the end of 2022, then it got delayed to Q2 2023, and now the best guess is September 2023. Milestone 2 was delayed two quarters behind initial estimates. We now move to the next milestone which introduces advanced trading features and a public testnet slated to go live in May.

Revenues

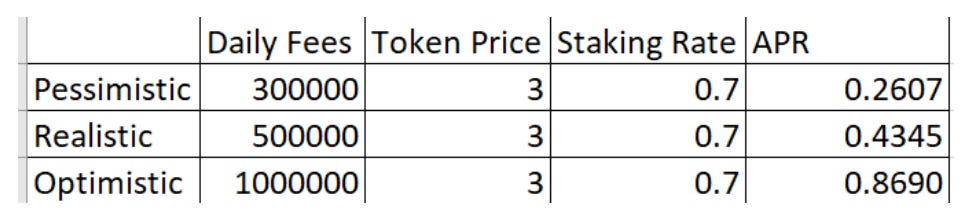

V4 will allow governance to direct trading fees and the most likely outcome would be a world where stakers and validators receive fees; vastly different from the current system where the fees accrue to the equity holders. It is easy to back out hypothetical yields based on projected revenues and percent staked.

Below is a rolling window of daily dYdX fees. We can see that it peaked at over 2.5m a day in November 2021, but has subsequently come down and is now slowly trending up from the bottom of 200k in October to 300k in February 2023.

We will use this formula which annualizes the fees and divides by the dollar amount staked. Looking at the tokenomics, there will be 250 million dYdX tokens when staking begins. At current prices that is a total of 750m USD possibly staked. However around 50 million of those tokens are earmarked for the liquidity staking pool, safety staking pool, and community treasury. Assuming those cannot stake we have 200 million tokens left. GMX and GNS all have around 70% of their liquid supply staked so will use those numbers also. The only other variable is dYdX fees.

Here is an estimate on what the staking yield would look like in September when the protocol is live. The fees that will be returned are ridiculous at these prices and amount staked. There will be some unlocks later in the year that will take the staking rate down by half if everything is staked, but even then the yield is insane. Real yield narrative intensifies.

5 Conclusion

In this article we provided data to support our thesis that there are three secular tailwinds that will drive the decentralized perp ecosystem: crypto trading volumes will increase , decentralized volumes will increase relative to centralized volumes, and decentralized perp volumes will increase relative to decentralized spot volumes11.

Then we examined market structures of exchanges from DeFi spot, to CeFi spot and perp, and concluded that exchange market structure is more monopolistic in nature. dYdX is the current market leader and the upcoming V4 features will only serve to solidify its lead. v4 is a large upgrade over V3 and the current generation of decentralized perpetual protocols.

Exchange coins are one of the best performing sectors of crypto, because they are profitable12. V4 will return fees to stakers and align the dYdX token to usage of the protocol. We believe that the dYdX will have strong performance relative to its sector and the broader market.

Note: Nothing in the article constitutes professional and/or financial advice. Ape if you want to ape. Special shout out to those who helped with data sourcing or answering questions. Most of the decentralized perp data was provided by Shogun and you can view his dune analytics page which has a bunch of other interesting data tables. dYdX specific data and questions were answered by the dYdX team. Centralized data was sourced from the Block, while decentralized spot data was pulled from Defillama.

Perpetual and future will be used interchangeably in this article

Strongly argue for the best

Categories taken from coingecko. There are overlaps here as BNB is both an L1 and a exchange

Without incentives. Can't really buy a stablecoin for appreciation either

Data is from top 10 exchanges by volume

The data is only from 2021 onwards as only uniswap really had volume

Would like to see grants fund other alternative frontends

Just doing a simple volume comparison

This format would be impossible on Starkware

For the less liquid products, it is possible to first start as an AMM and slowly upgrade to an order-book model after certain KPIs are hit

It's more like a piecewise step function due to markets cycles

Without inflation rewards, I cannot think of another non L1/L2 sector

"V4 will return fees to stakers and align the dYdX token to usage of the protocol"

dYdX historically retained 100% of the fee revenue and paid rewards via existing dYdX token supply. Is that changing? Is there a plan for stakers to receive a % of $ fee revenue? Or is this still dYdX stakers earn dYdX tokens?

Where did you get the historical Perp DEX volume data? I’ve been unable to find