Failed Polymarket Oracle Attack

Avi Eisenberg on Mango Markets without the success

1 Introduction

Polymarket describes itself as “the world’s largest prediction market,” with daily active users comparable to most perpetual DEXs combined. Users can bet on a range of topics, from politics (e.g., Who will win the presidential election?) to sports (e.g., Who will win the opening night NFL football match between the Ravens and the Chiefs?), pop culture (e.g., Which movie will be the highest grossing in 2024?), and even technology (e.g., If Chat GPT-5 gets released in 2024).

Due to the election, there has been increased interest in prediction markets, and Polymarket has even integrated with Bloomberg. Although volumes are expected to decline after the election, the long-term outlook for these markets is promising. For example, in 2020, the same presidential market had around $10 million in volume, whereas the current market has over 10 times that volume with almost two months remaining.

1.1 How the prediction markets work

These markets are similar to binary options, with fixed expiry dates where shares will trade at 1 or 0. For example, the Trump presidential market traded as high as 70% but recently dropped to 46% before Kamala Harris’s VP pick, and now sits at around 51%. If Trump wins, Yes shares will trade at a dollar (with No shares zeroed); if he loses, No shares will trade at a dollar.

The order book is structured similarly to a Binance ladder, and currently, there are no trading fees to stimulate demand.

1.2 Derivative Markets

With the influx of new users, Polymarket has been creating more niche markets, such as predicting which party will win specific states, whether particular words will be said during speeches or interviews, or even if a presidential debate will occur. Recently, they have introduced derivative markets based on their primary markets, like the example below with the following ruleset:

This market will resolve to "Yes" if Kamala Harris is more likely to win the 2024 US Presidential election than Donald Trump for any continuous period of 2 hours or greater, between August 22, 2024, 12 PM ET, and August 31, 2024, 11:59 PM ET, according to Polymarket. Otherwise, this market will resolve to "No".

This market didn’t attract much volume or open interest, though there were a few days where she was ahead during this period. Polymarket noticed this and responded by creating a new market with more aggressive rules.

The favorite to win on September 6 will be determined by looking at the 3 hour time window between 12 PM ET and 3 PM ET on September 6. This market will resolve to whichever candidate is ahead more than the other during this period. The relevant data points will be those each minute during 12 PM ET to 3 PM ET (i.e. 12:00, 12:01 up to 2:59 PM ET) for each of the candidates. Each of these data points will be compared minute-by-minute, and this market will resolve to whichever candidate is ahead more than the other.

It’s likely clear where this is headed: someone attempted an Avi Eisenberg-style attack to manipulate the market, but the attempt failed. Since this is crypto and everything is public, it was easy to trace what happened and understand why the attack didn’t succeed. Below, I’ll break down the sequence of events, what went wrong, and what the attackers could have done differently.

2 Setting the Stage

Trump's election odds have been rising all week, with well-known election pundit Nate Silver recently giving him a 60% chance of winning in the polls. Polymarket odds have followed suit, with Trump’s chances increasing from below 50% a week ago to a high of 53.25% this morning at 11:00 AM EST.

It is no surprise that in the reciprocal market for the favorite to win by Friday, Kamala’s chances were slowly decreasing from a high of 50% to around 1.6% at around 11:00 AM EST.

2.1 Massive OI buildup

Throughout the week, there was a significant buildup of open interest (OI) with people bidding on Kamala, even though she appeared unlikely to surpass Trump for the specified 50% of the 3-hour time block outlined in the Polymarket rulebook. Based on the open interest, the payout could have been around $1.5 million if the large holders were collaborating, as they purchased shares for under 5%, yielding a potential 20x payout.

2.2 The manipulation attempt

At around 12:48 PM EST, 48 minutes into the TWAP snapshot, with Trump comfortably ahead of Kamala, a group of whales began purchasing Trump "No" shares to push the price down. They attempted to manipulate the presidential election market for the next 45 minutes but were ultimately unsuccessful, giving up around 1:30 PM EST, when the derivatives market bet concluded.

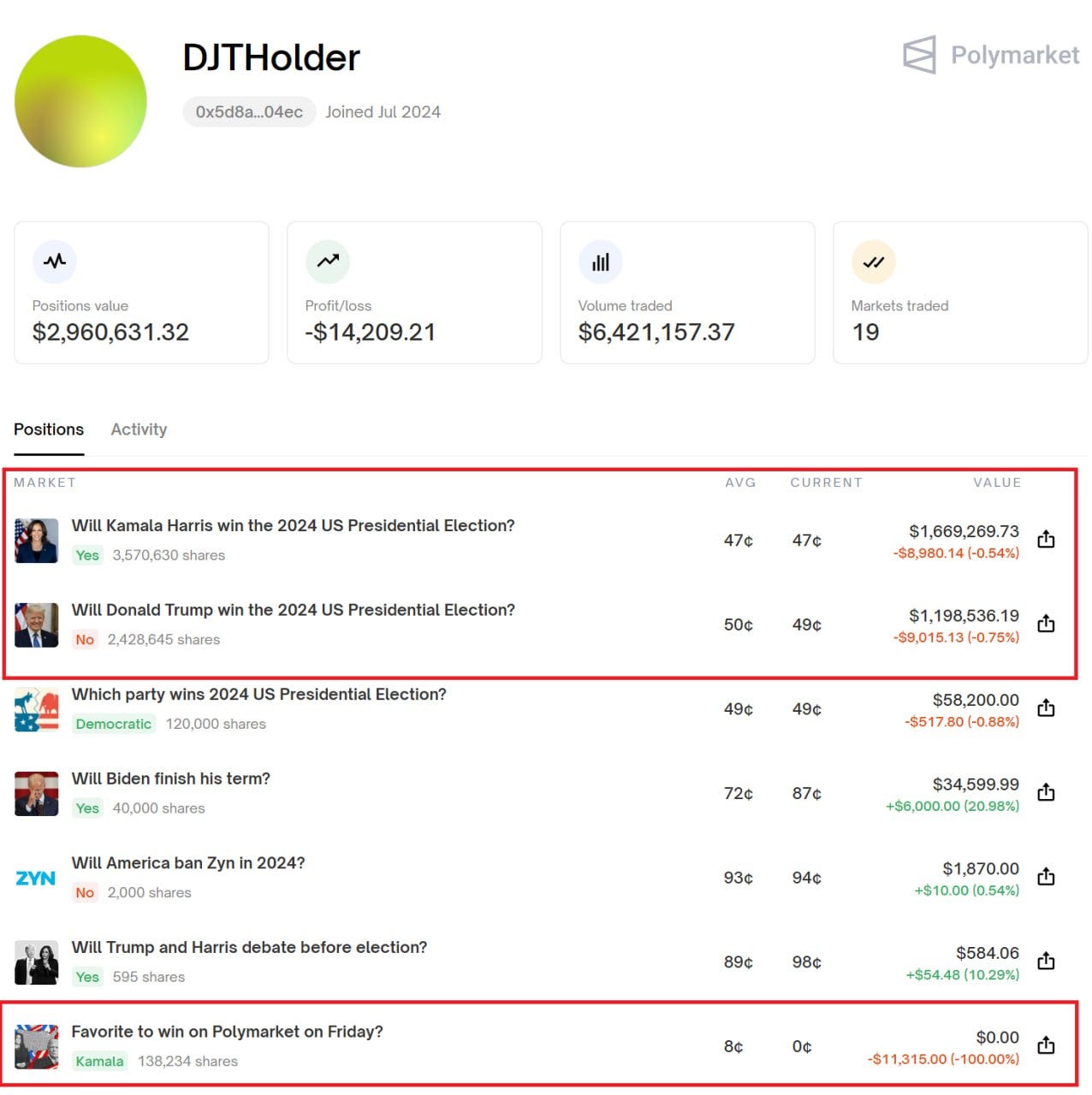

Watching in real time, DJTHolder initiated the action by depositing 600k, 1.5m, and 500k for a total of 2.6m and immediately moved to the election market to buy Trump "No" and Kamala "Yes" shares. The trader had about $300k in the account beforehand but then went all-in on Harris "Yes" and Trump "No" shares, while also holding approximately 138k shares in the derivatives market.

2.3 Others Join the Fray

It is hard to discern if this was one actor or multiple but after DJTHolder ran out of cash, a few more wallets had the same funding pattern. Polymarket is on the Polygon (PoS) blockchain so users have to bridge to the chain in order to fund their Polymarket accounts. User 23740982730487230, withdrew 1m from Coinbase and then used the circle CCTP bridge send to Polygon. User 230489093826, also pulled from coinbase and used the CCTP bridge.

Overall, four of the top six Trump "No" holders accumulated their positions in an attempt to manipulate the market. I estimate around $7 million was spent, with current losses around $200k. However, that figure could rise if they attempt to exit their positions, as they represent a large portion of the open interest (OI). It’s unclear if they intend to hold this binary option through the election. Losing $7 million to try and make $1.5 million would be quite fitting.

3 What went wrong

3.1 Not Enough Size

The manipulators made three key mistakes: they started too late, lacked sufficient firepower, and didn’t read the fine print. They were likely caught off guard by the liquidity of the order book, as they were only able to push the market down for about 4 minutes out of the required 90, despite spending $7 million. In hindsight, I estimate they probably needed at least $20 million to succeed in this attempt.

3.2 Not Enough Time

Additionally, they only started at 12:48, meaning they had already given the other side a 48-minute lead out of the required 90 minutes—over 50%! It’s unclear why they began so late, but it was likely due to bridging friction. As previously mentioned, to trade on Polymarket, USDC must be on the Polygon PoS network. However, due to the recent Matic-to-POL upgrade, Coinbase temporarily suspended all USDC deposits, which may have caught them off guard.

This meant that, instead of a 30-second withdrawal from the Coinbase exchange (where the manipulators had their funds) to make a deposit, they had to rely on the Circle bridge, which takes around 20 minutes. (While other bridge options exist, only Circle could handle the required transaction size.) Below is a screenshot of the exact bridging path the manipulators used.

This friction made it nearly impossible for them to send funds quickly enough to buy Trump "No" shares, as every time they ran out of money, they had to wait 20 minutes. It is tough to win a basketball game to 90 points if you spot your opponent a 48-0 lead.

3.3 Not reading the rules

Upon closer inspection, only the final price of each minute mattered, while the other 59 seconds were irrelevant. The manipulators should have swept the order book every 59th second and held for one second to secure the desired print, rather than placing large limit orders that others could take and destroy their liquidity. This would have been a more cost-effective method for the oracle attack.

3.4 Was it even worth it

Honestly, I’m not sure today’s attack had the right risk-reward metrics. The oracle they attempted to manipulate was more liquid than the market they were trading—exactly the opposite of the Mango Markets exploit. In that case, Avi profited by manipulating an illiquid spot oracle while holding a liquid perp position. He opened an $18M MNGO-perp position (with $5M USDC), used about $4M USDC to push the spot oracle 30–100x higher, and realized a profit of around $116M.

4 Conclusion

As prediction markets grow in popularity and derivatives are created, they become increasingly vulnerable to manipulation. Fortunately, today’s attempt was amateurish and successfully thwarted. It’s crucial to remain aware of the associated risks.